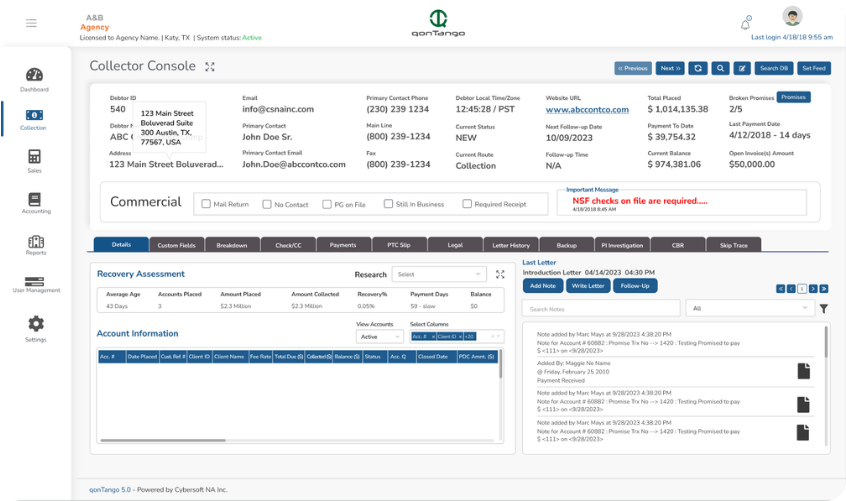

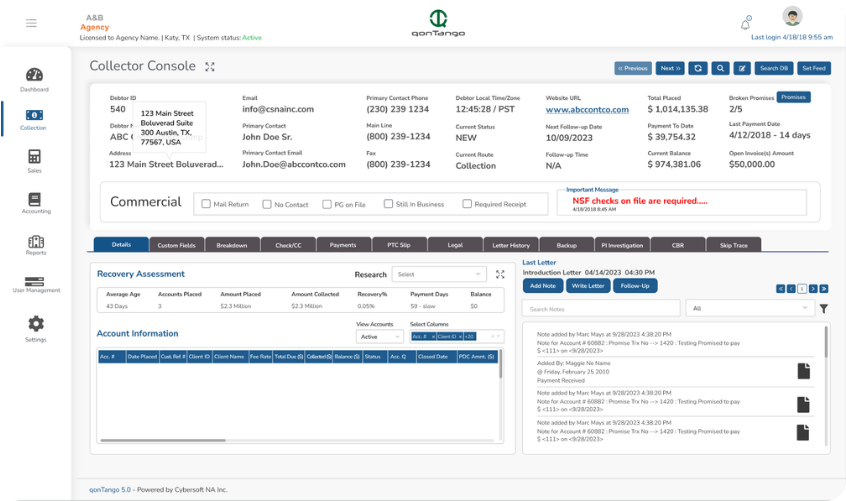

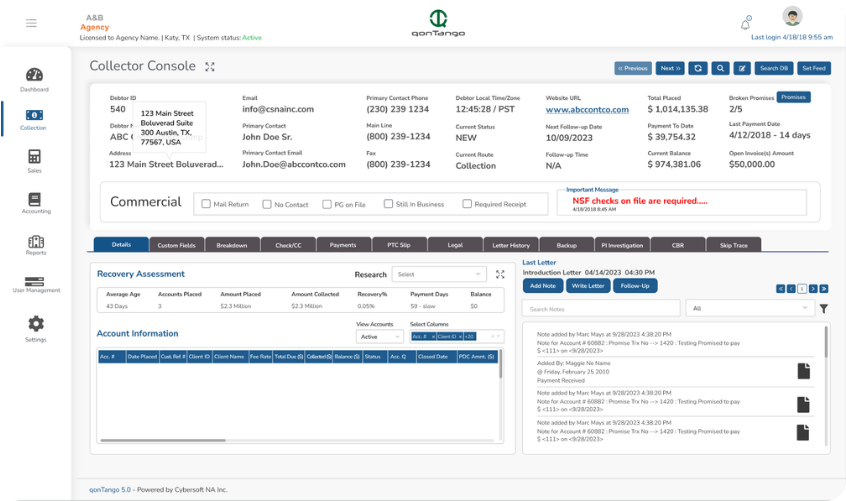

Experience the Next Generation Of Commercial Debt Collection Software

Reimagine your approach to debt recovery with qonTango.

Reimagine your approach to debt recovery with qonTango.

Experience the power of true customization. Adapt qonTango to suit your needs. Not the other way around

For nearly two decades, qonTango has led the way in collection solutions. Now, we introduce qonTango 5.0—a leap forward in AI & data-driven debt recovery.

A true Progressive Web App (PWA), which is compatible with all major platforms:

Industry-leading encryption protocols ensure data safety at all levels, whether deployed on cloud or on-premises.

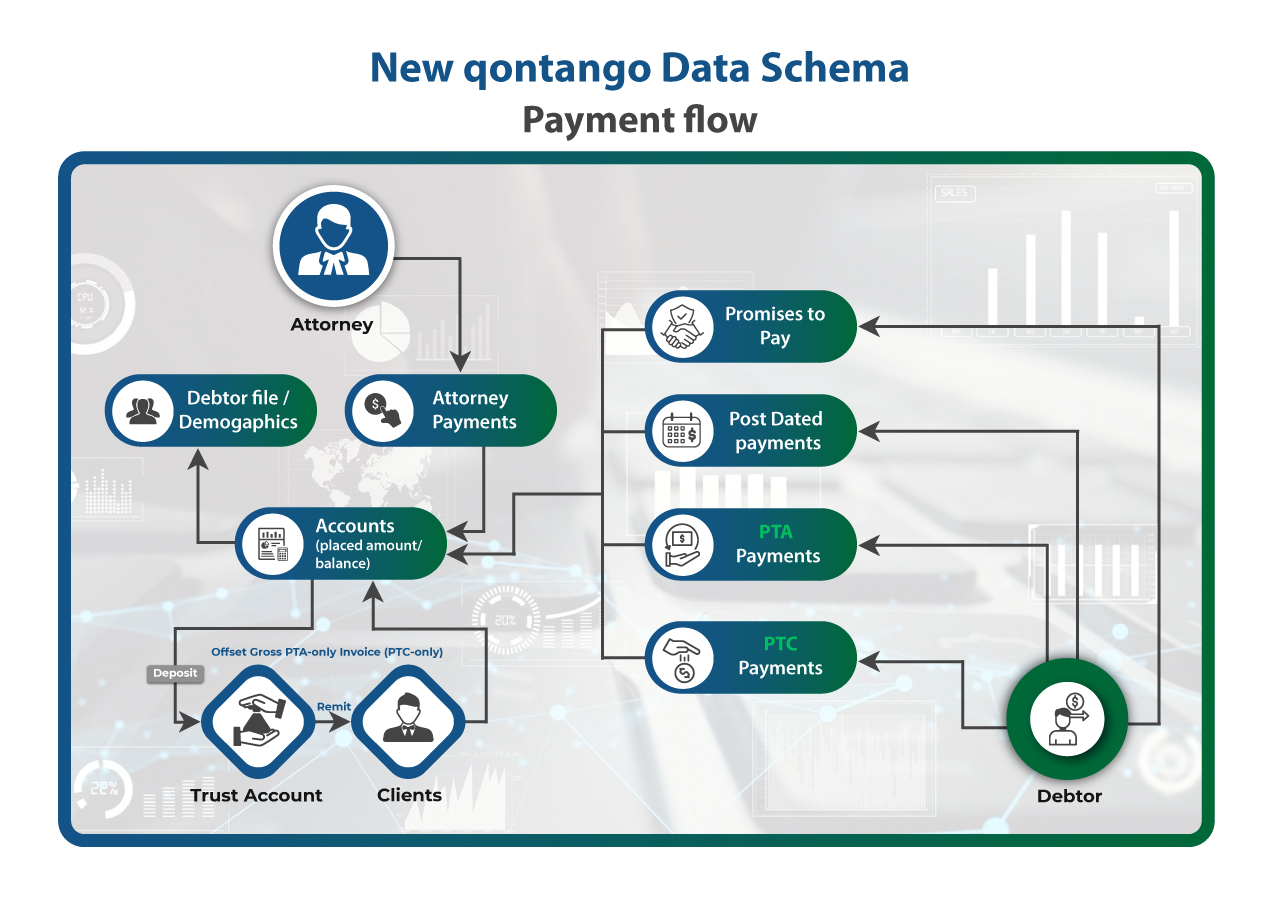

Designed to communicate with various software, ensuring seamless data exchange at all times.

We are a rapidly growing commercial shop and due to expansion we have used and had demos of many different software vendors and Qon Tango was by far the best we come across. It has a common sense interface and reports. It is also has a fantastic sales CRM so you have the best of both worlds in one program and it all speaks to each other seamlessly.

Our experience with qonTango has been remarkably positive, as it has integrated into our financial workflow, making debt management a much effortless process. The interface is user-friendly, allowing all of our team members, regardless of their technical background, to use it without any hassle.

What is there to say? We initially wanted a simple debt management software. qonTango stood out because it was cheap and got the job done. What I did not realize was that it had so much more to offer. My firm utilizes its Sales CRM and legal handling features, which have helped in improving customer relations greatly.

qonTango is a debt management software designed for collection agencies. It boasts a multitude of features, which aim to handle redundant tasks.

Although the software is not free, we do offer a 3-month trial. Agencies can test the entire suite, without any restrictions, to assess if it fits their needs.

Apart from our industry-beating prices, qonTango offers a lot of features. It is not limited to debt management and can boost productivity for various departments.

Yes! We offer included support, for a seamless transition to our platform. Our experienced teams ensure there are no disruptions during the process.

No! qonTango remains online 24/7, so your clients can access their accounts without any issues.

The latest iteration of our software suite utilizes state-of-the-art security protocols. We have also integrated document management into it, instead of relying on third-party offerings, ensuring it remains safe at all times.